Live Trading System Signals on 02/06/2024

- Capstone Trading

- Feb 6, 2024

- 2 min read

The live trading system results for the 250K Portfolio, 60 strategies was -$3,875 on the day. The hypothetical results were -$4,472.50 as we phased into the portfolio today. The portfolio was down in a -$10.5K hypothetical drawdown after yesterday's trade (and after an equity peak on Friday). Today, when it was almost in a 1k drawdown and the market opened up without extreme market internal readings so we entered the portfolio intra-day in the first hour, taking positions and turning on automation for 60 charts.

Our live trading results are down -1.6% on the year. We are optimistic working with this portfolio setup that has strong hypothetical performance in the current market environment. We are glad to have a drawdown entry today today after a rapid drawdown and entered according to our strategy. We will manage risk and continue to balance the portfolio if the Nasdaq continues to be a sloppy market in a low VIX environment.

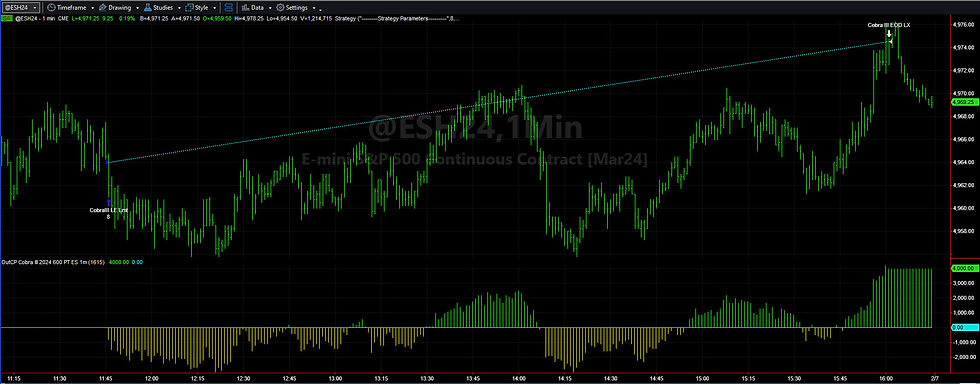

The trade of the day was Cobra III E-mini S&P.

The hypothetical signals for each market were:

E-mini S&P = +$300 E-mini Nasdaq = -$3,385

Gold = -$825

Silver = -$525

Crude Oil = 0

Natural Gas = 0

Soybeans = -$37.50

Coffee = $0

Euro Currency = $0

The hypothetical drawdown for this portfolio over the last two days was a rapid -$15k drawdown after Friday's equity peaks. We are looking for a bounce as we move towards a favorable time of the week. The VIX dove at the close to break 13.0 but settled at 13.06. We should have seen a distribution day by now but have seen only small pullbacks as the VIX contracts once again, which is bullish. The market has had several pullbacks that get supported. We are looking for another sustainable intra-day trend after two days of sideways action near the highs.

The hypothetical trading system signals for the Stock Index Portfolio 27 E-mini was -$2,640.00

The hypothetical trading system signals for the Stock Index Portfolio 27 Micro was -$261.75, taking the same trades as the E-minis.

V-Reversal III and V-Reversal V E-mini Nasdaq were up +$900 and $890 on the day. We continue to work on integrating our portfolios with some V-Reversals without increasing risk. V-Reversal II and IV are my favorite. I show how to combine these in the video published today.

Comments