SR COUNTERTREND MAX

The SR CounterTrend II trading system trades all markets with the same parameters. It is a wide ranging, low frequency, counter trend trading system that is fully automated to trade a list of commodity and futures markets.

We consider the SR CounterTrend strategies to be our greatest trading system “find” in 20 years with respect to a multi-market strategy that uses the same parameters. We typically treat different market sectors differently. It took many years to find a simple strategy setup that trades all strategies the same way.

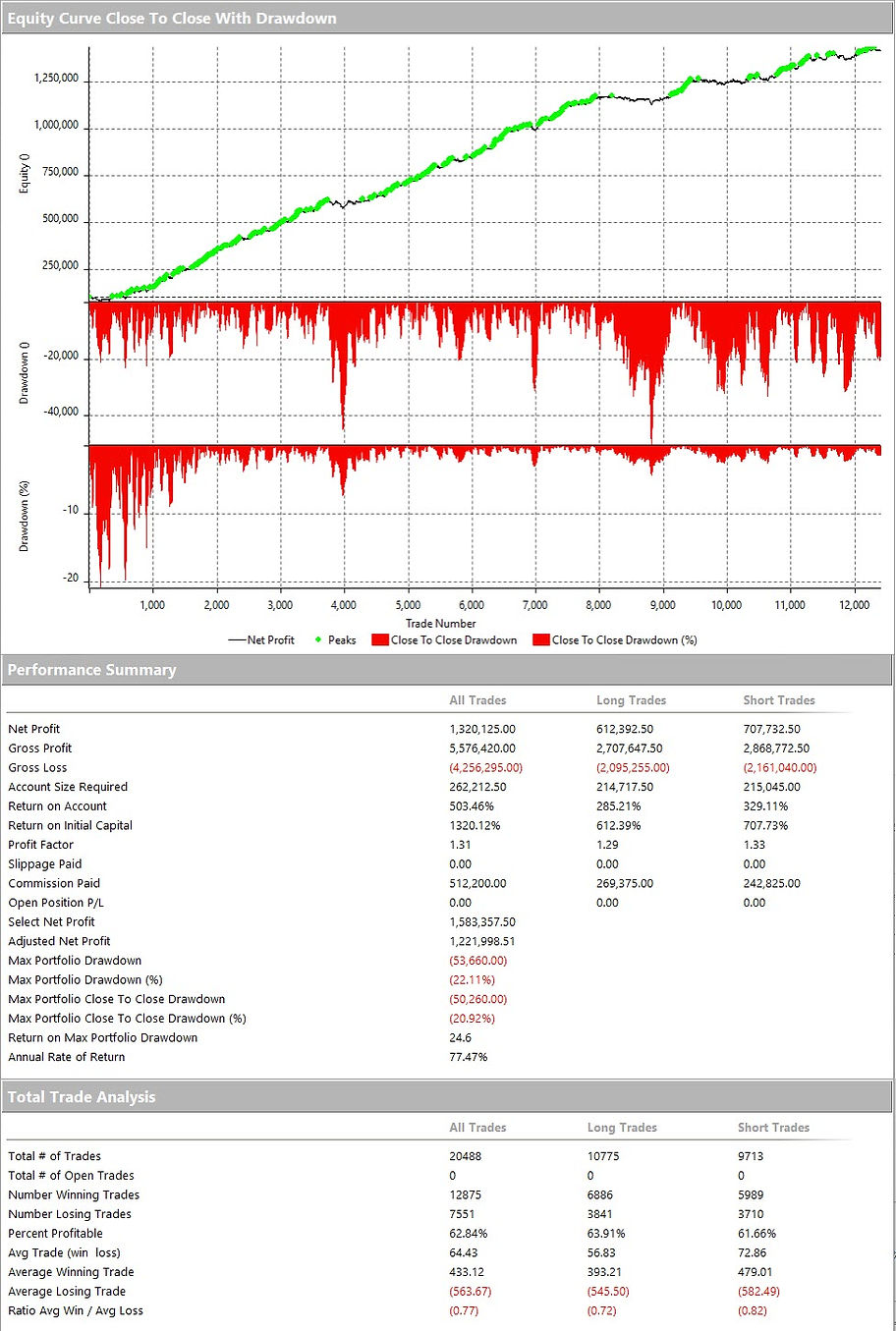

The SR CounterTrend MAX is a portfolio that includes 7 different variations of the SR CounterTrend trading system. Each variation trades six different liquid futures markets with the exact same set of parameters. The markets in this portfolio include E-mini S&P, E-mini Nasdsaq, Gold, Silver, Crude Oil, and Natural Gas. With seven different variations on six different markets, there are 42 combinations total.

HYPOTHETICAL PORTFOLIO PERFORMANCE STATISTICS