July Results and August Strategies

- Capstone Trading

- Aug 1, 2025

- 2 min read

The Portfolio Calculator has been updated through July 31st.

The hypothetical results for the portfolios for the month of July are:

Stock Index Portfolio 18 = -$5,705.00 per E-mini

Two System Portfolio NQ = -$705.00 per E-mini

July marked a new low for trading ranges in the 2020s, with an unprecedented number of days where the 5-day average range stayed below 1%. This stretch of compressed volatility was accompanied by what we’ve come to call Persistent Pollyanna Pavlovic Dip Buying—a market behavior where 0.2% dips from the day session open were repeatedly bought with near-automatic precision.

However, despite the dip buying, the day session's upside follow-through steadily weakened throughout the month. Markets were grinding higher, but with diminishing momentum and increasingly narrow ranges.

That all began to change at the very end of July. Both the final day of the month and the start of August have already shown signs of renewed range expansion and more decisive intra-day moves—offering better trading opportunities and a break from the stagnation.

Our strategies had been proactively adjusted earlier in the year to capitalize on the high-volatility regime we saw in the spring, particularly in April when pre-market volatility filters were essential. Fast-forward just three months, and we encountered the lowest ranges of the decade—a dramatic and rapid flip in volatility.

This kind of shift underscores the importance of staying adaptive. Markets move not just in direction but in character, and July was a textbook case of how quickly that character can change.

For August we continue trading the Stock Index Portfolio 18. It ended the month in a 22K out of 37K worse case drawdown so it is still at a good starting point. The hypothetical results are below.

Stock Index Portfolio 18 Hypothetical Performance Summary

Additional consideration is being given to some of the E-mini S&P countertrend trading systems that have done really well in the month of July and hit equity peaks during the month.

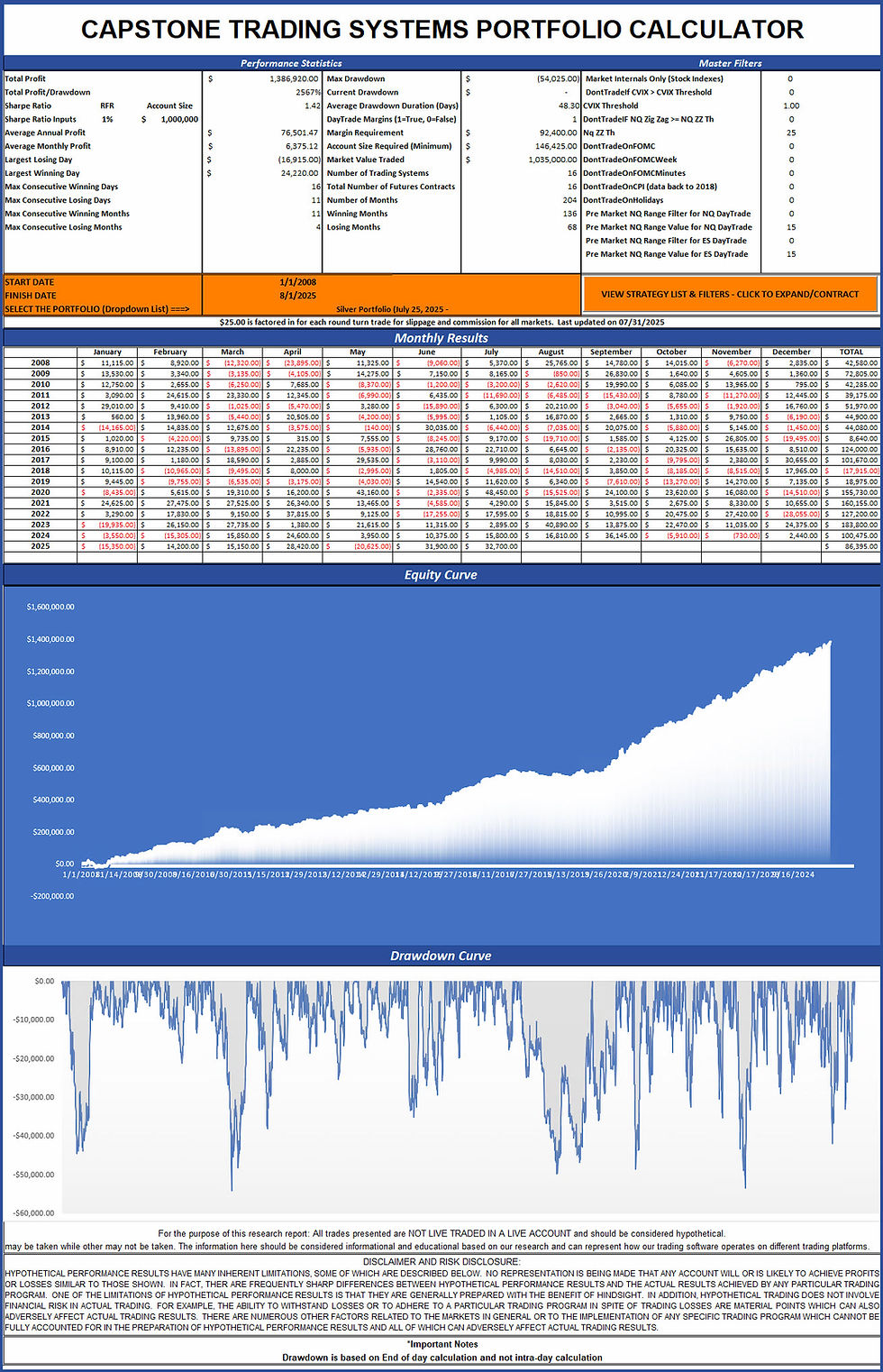

The Silver Portfolio is new and is not listed yet on the site. It is simply all 16 strategies for Silver. The hypothetical performance summary for the Silver portfolio is below and it tests well back to 2008 and ended the month at equity peaks.

Silver Portfolio 16

Hypothetical Performance Summary

The Two System Portfolio NQ hit equity peaks on July 29th before it was down about -$3K on July 30th with no trades on July 31st and -$705 on the month.

Our Top Setups for August continue to be: Stock Index Portfolio 18

Two System Portfolio NQ - Contact Us for pricing

Silver Portfolio - Added to Website Soon - Contact Us for pricing

Comments