Silver Futures Portfolio

- Capstone Trading

- Aug 9, 2025

- 2 min read

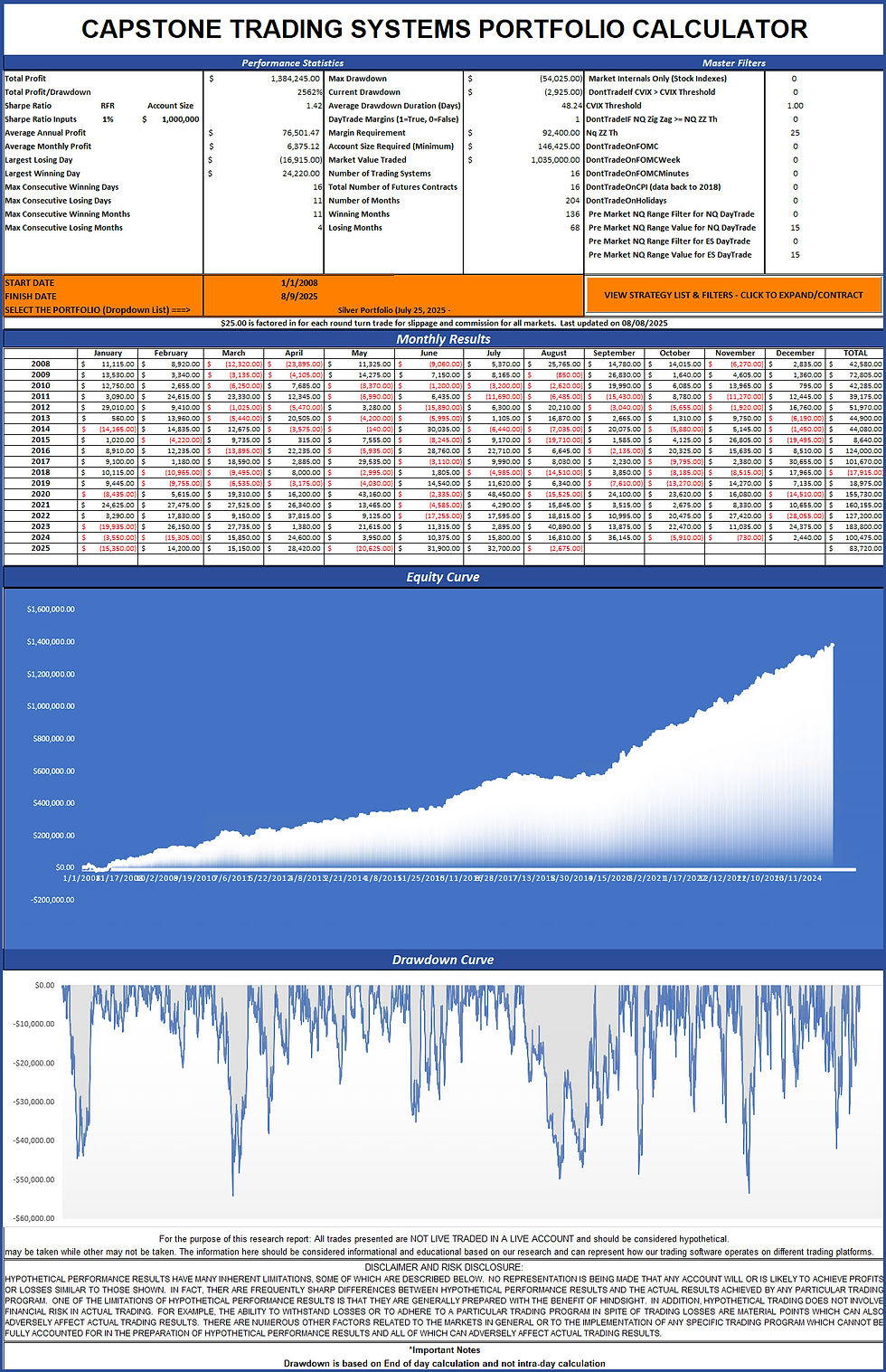

The Silver Futures Portfolio that was released on July 25, 2025 simply includes all 16 Silver futures trading systems from the All Strategy Access. The combination of this portfolio shows hypothetical results of $13,900 since July 28, 2025 with 3 equity peaks since its release. This portfolio tests well back to 2008 with many of our SR CounterTrend strategies that were originally developed in 2009.

While it is the natural tendency to optimize and generate nice straight line equity curves for each strategy, the approach is to combine basic, un-optimized strategies that have been around and place them into a portfolio. Selecting strategies that are at equity peaks along with strategies that are in drawdowns (at different cycles) using different methodologies (trend, counter trend, mean reversion) provides a diverse portfolio selection. Limiting bias and curve fitting are critical in developing a trading systems portfolio.

The Portfolio results for the Silver Futures Portfolio testing back to 2008 with $25 round turn slippage and commission are below.

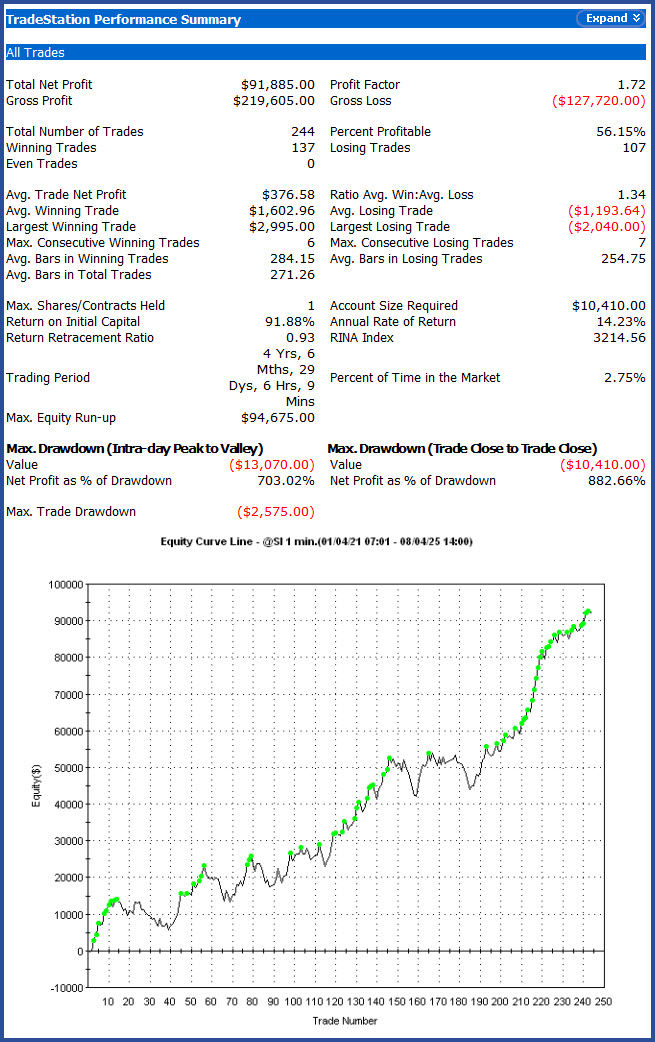

Highlighting SR CounterTrend Active 2024 by expanding stop losses and profit targets from $800 and $1000 per contract thresholds to a $2000 stop loss and $3000 profit target while expanding the Range requirement for this trading system show the following results since 1/1/2021 inclusive of $25 round turn slippage and commission.

Adjusting for volatility and higher prices is one of the biggest factors when adjusting trading systems over time. Markets have the tendency to remain in a volatility or range mode for a while and then there are fundamental changes in the market or the gradual rise to higher and higher prices eventually requires parameter adjustments for expanding daily dollar ranges.

The Silver Futures Portfolio can be leased below with as an Annual Subscription.

Comments