Top Nasdaq Trading Systems for Post Election and 2025

- Capstone Trading

- Nov 1, 2024

- 4 min read

Eight Top Trading Systems for Nasdaq Futures: Post-Election Strategies and Trading into 2025

In this video, we're diving into our best trading systems for Nasdaq futures in the post-election market and as we move into 2025, which starts in only two months. We’ll review each strategy in detail, along with the overall portfolio.

Yesterday, we took a look at Nasdaq, and asked: Will it drop below 20,000? And will it close below this level? We anticipated that it would take out 20,000, but it did not. It traveled almost 500 points and reversed 8.5 points away from 20,000. The Nasdaq can be one of the best markets to trade. It is not without volatility though. We discuss some indicators as well as the Top 8 Trading Systems for post-election and into 2025 for the Nasdaq futures.

Hypothetical Results are included in this video and screenshots.

Market Depth Indicators and Analysis

Market depth indicators—summarizing bid and offer levels—show that offers have generally led bids, suggesting persistent selling pressure. We’re monitoring this on both 1-minute and 15-second charts. Now, let’s go over yesterday's price action and then look at the specific portfolio of trading systems we’ll discuss.

Wednesday, Nasdaq exhibited challenging, narrow-range price action, hovering around 20,500. Despite Wednesday’s rally hinting at continued gains, the market reversed, gapped down overnight, briefly popped, then sold off and rebounded several times before ultimately settling lower. This price action led to stealth downtrends, highlighting the challenges of timing entries and exits in this environment.

Top 8 Strategies for Nasdaq Futures

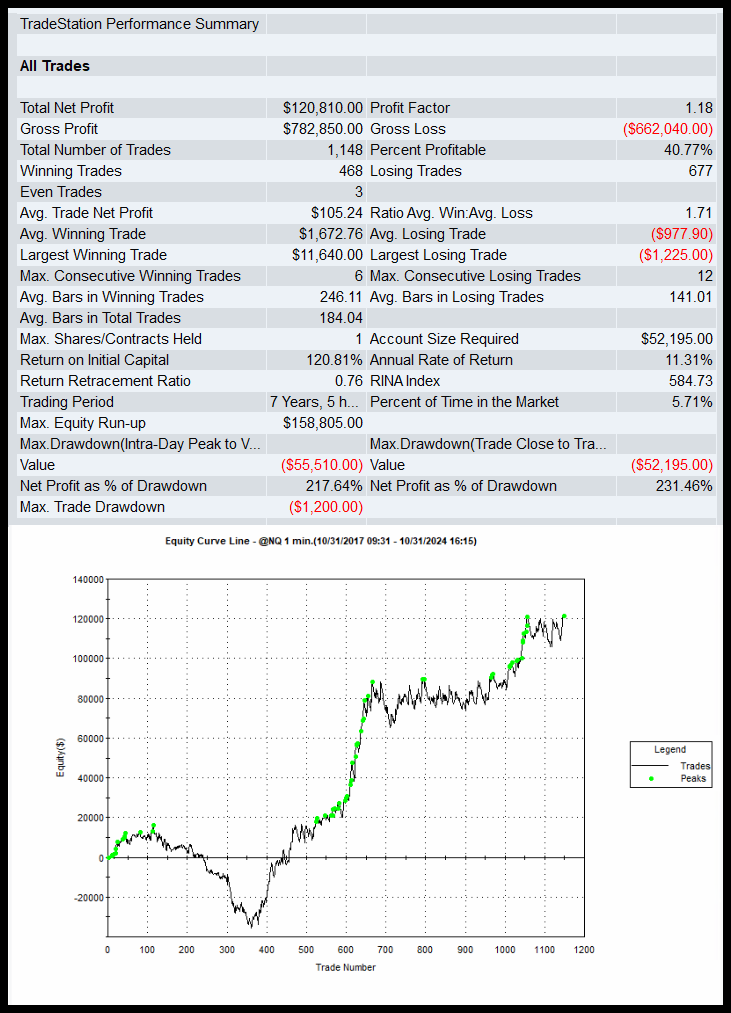

Let's explore the eight key strategies for Nasdaq futures trading in the current market environment, including hypothetical backtests, performance metrics, and drawdowns. These strategies have been tested over seven years with considerations for slippage and commission. Here are highlights from each strategy:

This strategy trades infrequently, with standout performance over the past seven years, It performed well on recent rallies, showing resilience in narrow-range markets. This is an ideal low-frequency strategy that avoids false breakouts.

Hypothetical Performance Summary

This strategy trades both long and short, adapting to twisting market conditions. In backtests, it has delivered strong returns since March 2021, benefiting from recent drawdowns for optimized entry points. It is well-suited for current market conditions.

Hypothetical Performance Summary

This strategy often profits from downtrends, executing short trades on gap-downs. Although it only wins 35% of the time, its $302 average trade profit offsets the lower win rate. It’s best traded as part of a broader portfolio to manage its frequent losing trades, especially in the current defensive market climate.

Hypothetical Performance Summary

Tick Wave

Designed for volatile, fast-moving markets, Tick Wave has been effective since 2020. With an $118 average trade profit, it can capitalize on big market swings. This is another strategy best suited to a portfolio for greater diversity.

Hypothetical Performance Summary

EVP (High-Frequency)

EVP trades more frequently, about six times a week, making it high-frequency within our portfolio. It has a lower average trade profit but complements lower-frequency strategies by taking quick advantage of market inefficiencies.

Hypothetical Performance Summary

OPV Short-Only

This short-only strategy has shown strong monthly returns, with only three losing months so far in 2024. It’s challenging to find effective short-only strategies, making OPV a valuable addition for downside protection in bear markets.

Hypothetical Performance Summary

Despite an atypical equity curve, Momentum Reversal captures trades missed by other strategies, providing counter-trend opportunities. It’s at recent equity peaks and has delivered strong gains in tough market conditions, adding unique diversity to the portfolio.

Hypothetical Performance Summary

Mirror 2020 (Mean Reversion)

A mean-reversion strategy, Mirror 2020 trades at market open, profiting from price pullbacks. This strategy’s unique equity curve and $145 average trade profit make it a solid addition to our diverse set of systems.

Hypothetical Performance Summary

Portfolio Performance and Customization

We’ve created portfolios with these strategies, adding or removing them to optimize performance. For example, removing EVP boosted portfolio returns by lowering the drawdown by $11,000. Balancing these systems helps maintain a smoother drawdown curve and enhances the Sharpe ratio, a key metric for evaluating risk-adjusted returns.

Adding all eight strategies leads to a total drawdown of around $32,000, a modest amount considering the combined strategy potential. We’re expecting higher volatility and potential big moves post-election, making these systems well-suited for this environment.

We show the hypothetical performance summary for a portfolio that includes 7 of the 8 strategies.

Hypothetical Performance Summary for Top 7 Nasdaq Strategies

Includes $25 round turn slippage and commission March 1, 2021 - October 30, 2024

Conclusion: A Flexible Approach for Post-Election Trading and Into 2025

Our Nasdaq futures portfolio, with its seven to eight core strategies, is well-positioned to adapt to post-election market volatility as well as the upcoming trading environment in 2025. We’ll continue to monitor market depth and bid-offer levels, which will play a crucial role in confirming trends.

Subscription for the E-mini and Micro Nasdaq

Comments