Trading System Signals on 07/30/2025

- Capstone Trading

- Jul 30, 2025

- 2 min read

Historically we don't trade on Fed Day but the recent data and with portfolio strategies that have been adjusted to trade higher volatility as well as the cycle of favorable price action during this time of month pointed towards a strong signal to trade today.

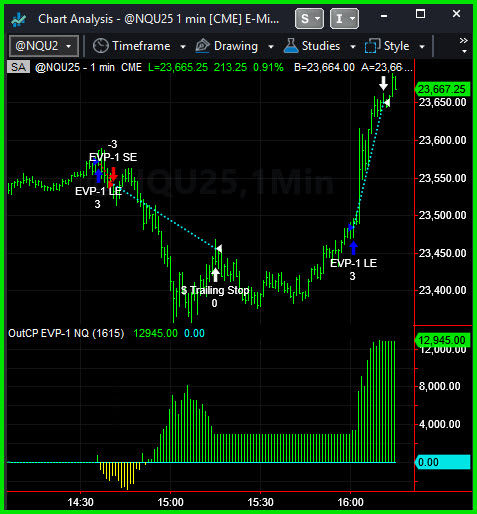

The market had typical volatility and a slightly narrow range until about 3 pm EST when it extended the range lower and the reversed and extended the range higher. The stock indexes sold off during the Powell press conference and then reversed after the conference as it often times does. The Nasdaq futures worked back towards 23,500 and then surged a couple of minutes after 4:00 pm EST based on META and MSFT earnings. The VSD Trender was stopped out with massive slippage while EVP-1 captured the trade of the day. Increasing position sizing on this strategy into the close helped move our live results to nearly breakeven. Screen shot below based on 3 E-minis.

The Two System Portfolio NQ hit equity peaks yesterday but captured the brunt of the unfavorable price action today going 0 for 3 with 2 V-Reversal trades and 1 Gap Continuation trade.

Hypothetical Trading System Portfolio Results:

Stock Index Portfolio 18 = -$2,945 per E-mini

Two System Portfolio NQ = -$3,000 per E-mini

In these stealth bull markets, where the market head fakes lower and then rallies into the close and accelerates after 4:00 pm EST, or continues drifting higher overnight, we consider the concept of going long in the afternoon if the market is down. "Joining" strategies that take these types of trades are one way to do it systematically. There could be a parabolic bubble melt up move and we could see dot com bubble price action in the Nasdaq 100 futures. A move to 25,000 or 30,000 is certainly a consideration in the short term.

Copper is not a market we want to trade right now. With a 50% tariff announcement today on Copper, we saw flash illiquid moves lower and approximately a -18% correction. Gold and Silver were down approximately -1.7% and -2.95%. The Silver Portfolio was up approximately +$12.1K to hit a new equity peak at 4:50 pm EST. (market closes at 5:00 pm EST). There were some nice swing shorts for the net gains in this new Silver portfolio. The real strength of trading Silver futures is that the moves in Silver are within historical norms making it a more "steady state" market.

Comments