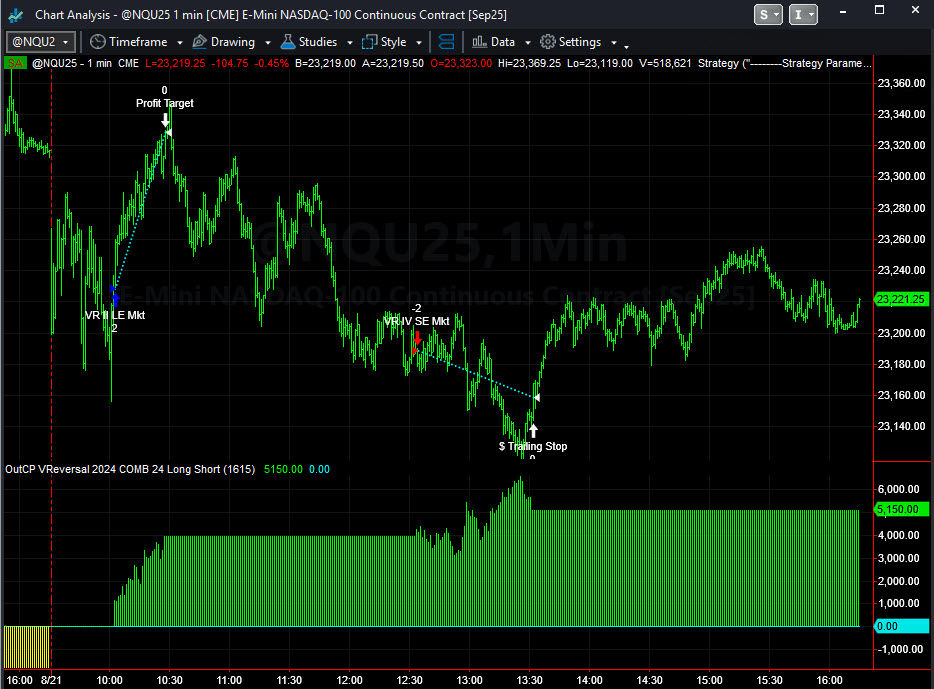

Trading System Signals on 08-21-2025

- Capstone Trading

- Aug 21, 2025

- 1 min read

Mean reversion reversals were the mode of the day. V-Reversal went 2 for 2 on the day. We saw a violent open followed by a "floaty and toneless" afternoon ahead of Jackson Hole. Jay Powell speaks at 10 am EST tomorrow. Many things that we think will move the market, have not moved the market lately. Maybe the contrarian trade tomorrow will be an uneventful tape or maybe it will be a wide ranging day. The current Stock Index Portfolio is setup to trade volatile news markets that we saw earlier this year. We look forward to tomorrow's trade.

Hypothetical Portfolio Performance

Stock Index Portfolio 18 = -$1,645 per E-mini

Two System Portfolio NQ = +$2,575

The violent open added some extra slippage on some of the trades including V-Reversal.

Stock Index Portfolio 18 moved into is more consistent time period of the month. The last 14 months it has gone 14 of 14 from the 21st through the second trading day of the following month.

In general, I am looking forward to post August trade as July and August have become the "summer" trade similar to the pre 2007 summer trades.

The Diversified 57 was down today -$7,700 per contract and is in about a 25K out of 39K drawdown.

Comments