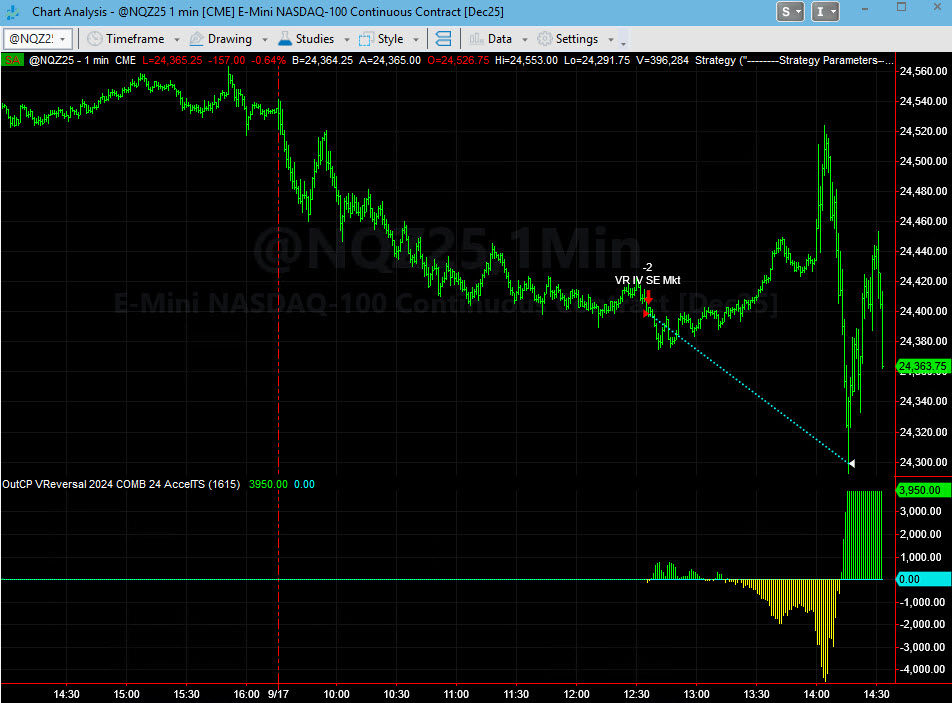

Trading System Signals on 09-17-2025

- Capstone Trading

- Sep 17

- 1 min read

FOMC Day was favorable for the Two System Portfolio NQ with a nice exit for the V-Reversal short. The other portfolios struggled with the sloppy price action. We continue to see a market that doesn't move much or is flashy/news driven. Steady state accumulations and distributions with some tone have been absent from the market for a few months. V-Reversal mean reversion has been ideal for this type of market environment.

Hypothetical Trading System Portfolio Signals and Results:

Two System Portfolio NQ = +$1,975

Stock Index Portfolio 18 = -$7,875

Stock Index Portfolio 37 = -$9,375

Diversified Portfolio 57 = -$19,720

Silver Portfolio = -$3,025

The Stock Index Portfolio 18 is still being tracked and is right at a worse case drawdown, looking for a bounce. We released the Stock Index Portfolio 37 two weeks ago and the drawdown today makes it an ideal entry point. The Diversified 57 could also benefit since it was at an equity peak yesterday and went half way to a worse case drawdown today.

I turned Proteus I, II, and III on after the market opened and it was down about -$5K on the day for the sum of the Proteus strategies for 1 E-mini Nasdaq per strategy.

Looking forward to tomorrow's trade and the post FOMC cycle.

Comments