Trading System Signals on 09-22-2025

- Capstone Trading

- Sep 22, 2025

- 2 min read

A More Favorable Turn in Market Price Action

Today marked the official first day of Fall, and with it came a refreshing change in market tone. After enduring a season of choppy, uneven price action—defined by overnight gaps, intraday volatility swings, and sloppy follow-through—we finally saw a day of more constructive trading patterns.

The Nasdaq 100 futures opened with a modest gap down, then steadily climbed higher throughout the session, ultimately extending their range above the 25,000 level. While the point gains in the indexes were smaller than some of the dramatic moves we’ve seen recently, the quality of the price action stood out. Instead of a sharp gap followed by erratic volatility, today’s gains developed during the day session itself, resembling the more traditional ebb-and-flow cycles that have historically provided better trading conditions.

It doesn’t take many days like this to recover drawdowns and move back toward equity peaks. The Nasdaq futures finished up around +120 points—not extraordinary in size, but highly favorable in structure. Healthy cycles of gradual expansion in both directions create opportunities for more consistent trend development, whether upward or downward.

Recent months have favored market patterns that work against our day-trade algorithms, while benefiting other types of approaches. But no algorithm is profitable all the time. As market cycles mean-revert, the very conditions that caused difficulty can shift back into alignment with our strategies. This is why it’s often best not to over-adjust or chase new setups too quickly.

In fact, one of the most frustrating dynamics in trading is switching to a new system just as the old one begins to work again. Today was a reminder that patience and adherence to a balanced portfolio can allow the natural rhythm of the market cycle to work back in our favor.

Hypothetical Trading System Portfolio Signals and Results:

Two System Portfolio NQ = $0 No Trades

Stock Index Portfolio 18 = +$12,240

Stock Index Portfolio 37 = +$15,910

Diversified Portfolio 57 = +$24,825

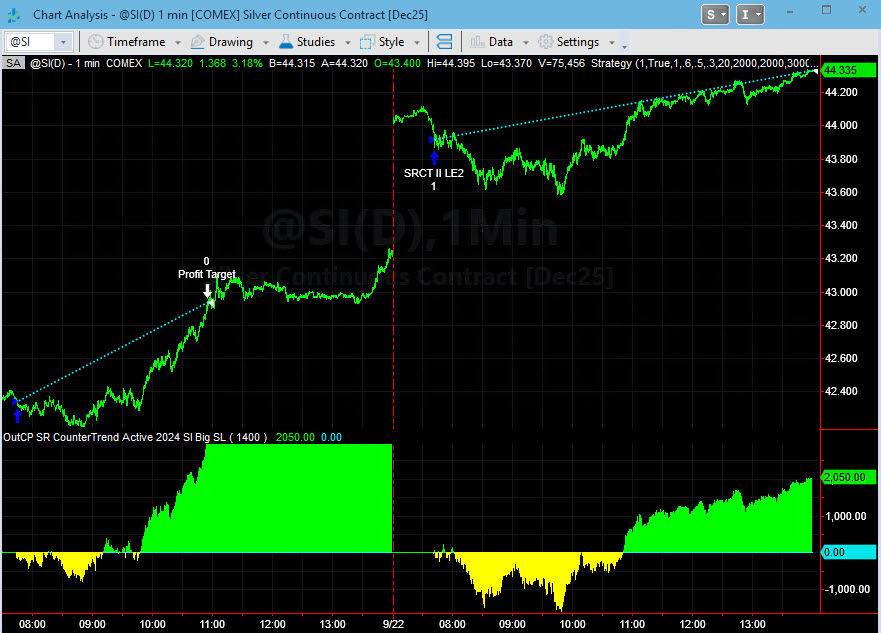

Silver Portfolio = +$1,225

I switched the Proteus strategies on after the day session open and tracked a gain of +$1,220.

All Portfolios had a nice trading day. The Two System Portfolio NQ had one of its rare "no trade" days.

NQ OT was the top strategy of the day and will close out this long before the end of the session.

SR CounterTrend Active 2024 Big SL has been on a roll. This strategy is part of the Diversified 57 and am working on adding it to NinjaTrader 8.

Comments