Trading System Signals on 09-24-2025 Silver Signals Hit New Equity Peaks

- Capstone Trading

- Sep 24, 2025

- 1 min read

The Silver Portfolio and Diversified Portfolio 57 hit new equity peaks again today with the Silver strategies hitting 6 winners out of 7 strategies that traded today. There are 16 strategies in the Silver Portfolio.

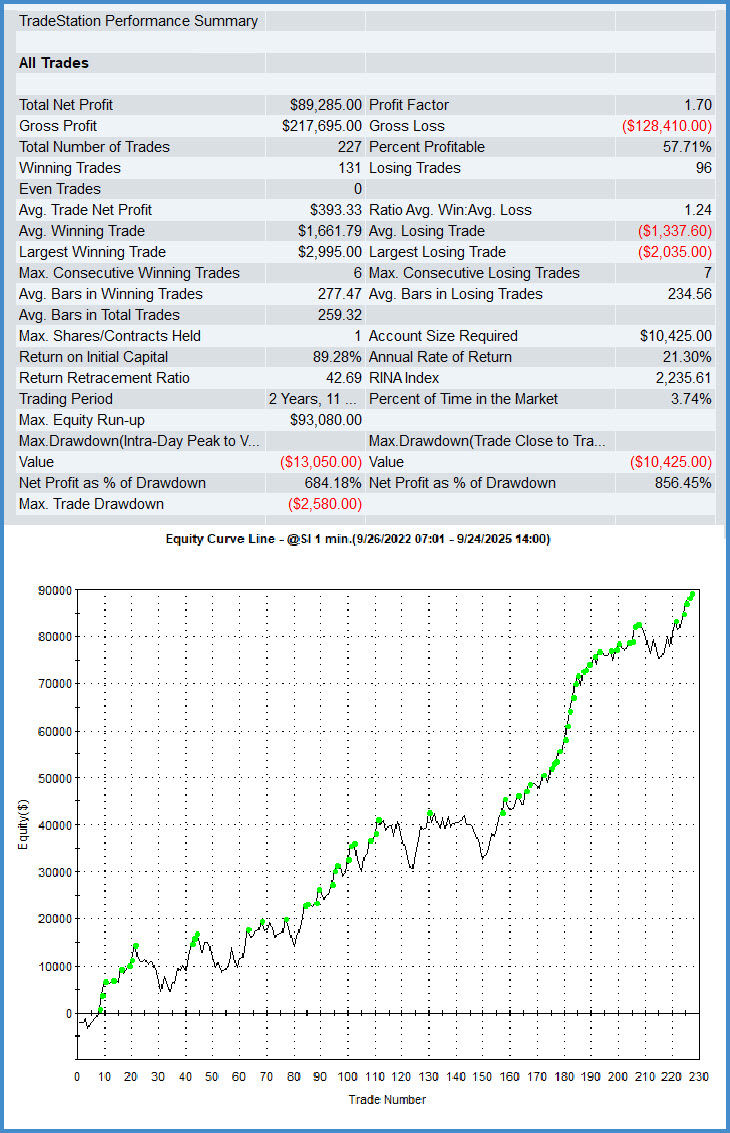

SR CounterTrend Active 2024 Big SL is one of the top performers over the last few years. We built SR CounterTrend Active 2024 Big SL from the 2009 version and made it trade more actively and increased the stop loss and profit target to account for higher market values and ranges.

SR CounterTrend Active 2024 Big SL Silver

Hypothetical Performance Summary

$25 Round Turn Slippage and Commission

All Portfolios were profitable on the day.

Hypothetical Trading System Portfolio Signals and Results:

Two System Portfolio NQ = +$85

Stock Index Portfolio 18 = +$1,890

Stock Index Portfolio 37 = +$270

Diversified Portfolio 57 = +$2,895

Silver Portfolio = +$4,325

Comments